![[Podcast] Green Finance and Sustainable Development in the Southeast Region – Part 2: Green Finance Needs in the Southeast Region and Solutions](/images/upload/img_background/ueh-bg-040821-082923.jpg)

[Podcast] Green Finance and Sustainable Development in the Southeast Region – Part 2: Green Finance Needs in the Southeast Region and Solutions

05 Sep, 2023

In accordance with the situation and the lessons learned in the countries analyzed in Part 1 of this article, the authors have proposed relevant recommendations to promote the application of Green financial policies effectively and uniformly in the Southeast towards sustainable development and adaptation to regional climate change.

The Need for Green Finance in the Southeast

With a high economic growth rate, the Southeast Region, an important driving force economic region of the Viet nam country, is considered the largest industrial center of the country, contributing approximately 45% of GDP and approximately 50% of the total industrial production value, export turnover and national budget. However, the negative externalities of production and consumption activities are seriously affecting the environment. In accordance with the data from the Department of Natural Resources and Environment of Ba Ria-Vung Tau Province, as of 2019, along the Dong Nai river basin, more than 10,100 industrial production enterprises were identified. In particular, a large number of enterprises do not treat wastewater in accordance with the national regulations. A large amount of wastewater discharged from industrial zones and export processing zones (EPZs) in Dong Nai Province, Ho Chi Minh City, and Binh Duong Province flows into the middle and lower reaches of Dong Nai River, Saigon River and Thi Vai River. The report on the state of the national environment 2016-2020 indicated that the Southeast is one of the localities with the highest amount of solid waste generation in the country during the analysis period.

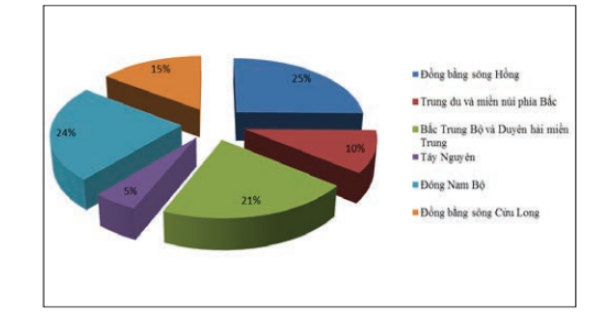

Figure 2: Solid waste generation in different regions in 2016-2020 period.

Source: National State of Environment Report 2016-2020

In accordance with the National Environmental Status Report 2016-2020, this area is recognized as the highest urbanization rate in the country. The population in the basin of Dong Nai River system, the section flowing through the Southeast region, currently, has an average urbanized population rate of approximately 56.3%. In the whole basin, many urban areas of different sizes are concentrated, with the characteristics of population distribution combined with the topographical conditions and the existing facilities of the drainage network, domestic wastewater of the basins. Urban areas are, currently, partially collected only whereas the rest is mainly drained into rivers and canals.

Therefore, green financial solutions are completely necessary to minimize the harmful effects of production and consumption activities in the Southeast Region. Nevertheless, the reality demonstrates that green financial solutions have not been developed synchronously in the Southeast Region. In particular, only some aspects of green finance are focusing on developing individually listed as green credit or green bonds

*Green credits

Green credits are those that banks support loan projects for the purpose of environmental protection, climate change adaptation and sustainable development. Green credit growth trend has long been developed in the world listed as energy saving, renewable energy and clean technology projects, aiming at the goal of economic growth associated with environmental protection. However, awareness of the importance of green credit has only been focused on in Vietnam recently.

Specifically, in March 2015, the State Bank of Vietnam issued Directive No. 03/CT-NHNN on promoting green credit growth and managing environmental and social risks in credit granting activities. The information from the Credit Department of Economic Sectors under the State Bank of Vietnam indicates that the growth rate of green credit in Vietnam has presented positive signs, increasing year by year. Green credit outstanding in Vietnam has increased from more than 71,000 billion dong in 2015 to 431,700 trillion dong in 2021. Of which, green agricultural debt in 2021 will reach 138,200 billion dong; The outstanding balance of renewable energy and clean energy reached VND 198,600 billion.

Unfortunately, currently, no specific statistics on green credit outstanding in localities has been introduced, limiting in-depth analysis of green credit at the local level. In addition, this reflects the reality of the limitations on the guiding and regulating role of local governments in the development of green finance.

*Green bonds

Green bonds are an effective solution applied by many countries around the world. To finance green projects, green bonds are attracting a lot of attention. The first green bonds were issued in 2007 by governments and commercial lenders in Europe. The issuance of green bonds increased thanks to the incentive programs of national governments. The global green bond market has grown from $4.3 billion in 2012 to $162 billion in 2018.

In Vietnam, in accordance with the summary of SSI securities company, the result of green bond issuance of some commercial banks and enterprises is approximately 20,000 billion dong. Notably, two Provinces in the Southeast region, Vung Tau Province and Ho Chi Minh City, have been approved by the Ministry of Finance to pilot local bond issuance, with a total amount of VND 2,500 billion to invest in projects dealing with environmental problems.

Consequently, the reality proves that the development of two popular green finance solutions, namely green credit and green bonds, in Vietnam in general and especially in the Southeast Region although it has received more attention. The ministry in particular is being very modest. Other solutions have not almost been applied or are being in the experimental stage. Compared to the environmental damage from production and business activities of industrial zones and the rapid urbanization of the region, the scale and the impact of green finance solutions are being too small and underdeveloped in a synchronized manner.

Proposing development solutions for the Southeast Region

In addition to the achievements, green financial solutions in the Southeast Region have not been performed as expected. The development of green finance activities has not been synchronized: many difficulties and challenges are being available. Mechanisms, policies, especially the directional and regulatory role of the government, are being limited. From a theoretical overview, the analysis of the current situation and the lessons from international experiences, the authors propose some solutions to develop green finance towards sustainable development and adaptation to climate change in the Southeast Region as follows:

In terms of the central government:

Creating a legal framework to develop diversified and synchronous solutions on green finance listed as regulations on the disclosure of information related to the environment of listed companies; Enhancing the role of the stock market in supporting green investment; Developing Green Insurance;

• Facilitating the development of the emission rights trading market.

• Continuing to improve the legal framework for current solutions listed as developing green credit and green bonds towards sustainable development.

• Researching and applying ESG criteria to green financial solutions.

• Adjusting appropriate mechanisms and policies and taking advantage of the support of international financial institutions to encourage credit institutions to participate more in green financial policies.

• Forming a Green Development Fund and mobilizing social capital through Public Private Partnership.

• Strengthening international cooperation on green financial growth policy implementation and sustainable development.

• Supporting local governments to develop green finance in accordance with the practical context of the regions.

In terms of the local government:

-

Actively strengthening the role of guiding and regulating green finance policies to suit the local context.

-

Facilitating the system of local financial intermediaries to participate more in green financial solutions.

-

Coordinating with central government and financial intermediaries in gradually applying ESG criteria to each specific project in the locality.

Please refer to the full paper on Sustainable Development and Climate Change Adaptation in the Southeast Region: The Role of Green Finance TẠI ĐÂY.

Author: Dr. Tran Trung Kien, Faculty of Public Finance - University of Economics Ho Chi Minh City

This is an article in the series of articles spreading research and applied knowledge from UEH with the “Research Contribution For All - Nghiên Cứu Vì Cộng Đồng” message, UEH cordially invites readers to watch the next Newsletter ECONOMIC No #83.

News, photos: Author, UEH Department of Marketing and Communication

Voice of: Ngoc Qui